aaii bull - what is market sentiment today : 2024-10-30 aaii bullSep 17, 2021 — AAII percent bears surged to 39.3% and percent bulls dropped to 22.40%. As a result, net bull-bear percentage plunged to -16.90%, the first negative reading since September 2020. Note that the . aaii bullLEVEL 2 KEY SPHERE. Type: Key Sphere Erases: Level 2 Sphere Locks, turning them into empty nodes.

1.4 Level 60 Gear Guide. 1.5.1 Weapons. 1.5.2 Armor. 1.5.3 Accessories. 1.6 Level 70 Gear Guide. Shadowbringers (Levels 70-79) 1.7.1 Weapons. 1.7.2 Armor. 1.7.3. 1.8 Level 80 Gear Guide. Endwalker (Levels 80-89) 1.9.1 Weapons. 1.9.2 Armor. 1.9.3 Accessories. 1.10 Level 90 Gear Guide. 2.1.1. 2.1.2. 2.2. 2.3.1 Tools. 2.3.2 Gear.

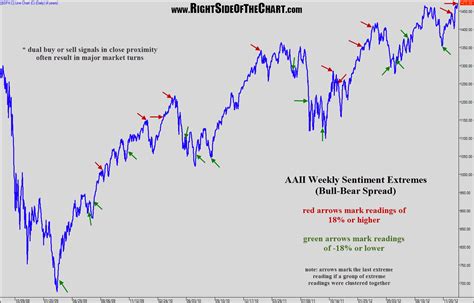

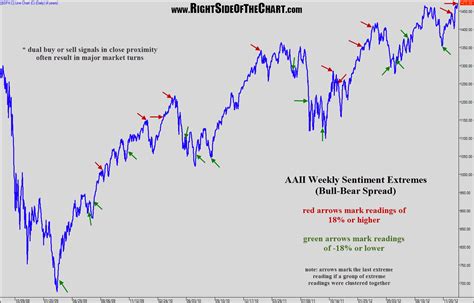

aaii bullSep 17, 2021 — AAII percent bears surged to 39.3% and percent bulls dropped to 22.40%. As a result, net bull-bear percentage plunged to -16.90%, the first negative reading since September 2020. Note that the .Mar 7, 2024 — The bull-bear spread (bullish minus bearish sentiment) increased 4.8 percentage points to 30.0%. The bull-bear spread is above its historical average of .6 days ago — Neutral sentiment among individual investors about the short-term outlook for stocks increased in the latest AAII Sentiment Survey. Meanwhile, optimism and pessimism decreased. Bullish sentiment, .Feb 9, 2023 — The bull-bear spread (bullish minus bearish sentiment) is 12.5%. This is the first positive reading in 45 weeks and the first above-average reading in 58 weeks. This .Jan 20, 2022 — The bull-bear spread (the difference between bullish and bearish sentiment) is now at –26, the most negative it has been since mid-2020. Plus, this week’s special question asked AAII members which .Sep 17, 2021 — The AAII indicators are making waves this week so I will cover two charts. AAII percent bears surged to 39.3% and percent bulls dropped to 22.40%. As a result, net bull-bear percentage plunged to .When the bull/bear ratio becomes extremely high or low, the market has generally formed a near-term top (high bull/bear ratio) or bottom (low bull/bear ratio). Large Block Ratio: This market sentiment indicator shows the relationship between large block trades, which are trades of more than 10,000 shares, and the total volume on the New York .aaii bull what is market sentiment todayAAII Bull Minus Bear (19.9) US Investors Intelligence: Bull Minus Bear (36.2) yardeni.com Note: Shaded red areas are S&P 500 bear market declines of 20% or more. Blue shaded areas are correction declines of 10% to less than 20%. Yellow areas are bull markets.Delve into the World of Economic Data. With YCharts, navigate the intricate landscape of global economic indicators. YCharts offers an industry-leading compilation of over 500,000 economic indicators and data points, so you (and your clients) can fully understand global economic trends.

aaii bullAfter a long and stable bull market that lasted from 2009 to 2020, we have experienced a rapid succession of bull and bear periods. For our current bull period, we are looking at stock market performance starting on April 1, 2020, and ending on December 31, 2021. Our bear market period encompasses the first nine months of 2022.

Apr 28, 2022 — The bull/bear ratio is a market-sentiment indicator that polls the the views of professional market participants on a weekly basis.

Apr 28, 2022 — The bull/bear ratio is a market-sentiment indicator that polls the the views of professional market participants on a weekly basis.

floor 2, could give no lower than 3% up to 7%, auto-def or spr boosts up to level 3 with a chance of auto-regen 1 or 2 or auto-refresh 1, floor 3 could give no lower than 5% and up to 10%, floor 4 could give no lower than 7% and up to 12%, floor 5 could give 7% to 15% also but auto-spr and auto-def boosts would be eliminated,

aaii bull